Shefflin Investment, LLC History

Past Acquisitions and sales

Fireside Apartments

108 Unit Apartment Complex

Colorado Springs, CO

Acquired May of 2012 for $3,950,000

Sold July 2018 for over $13,000,000

The property needed immediate repairs due to neglected drainage. In addition to repairs we made improvements to the landscaping, parking lot, and office. Over the term we held the property we added a dramatic front entry sign, courtyard, BBQ, picnic tables, and pool fencing. We installed windows with new dual pane energy efficient windows. We refinanced the property to return 85% of investors original investments, while maintaining significant positive cash flow.

Woodside Townhomes

72 Unit Townhouse Complex

Colorado Springs, CO

Purchased in 1993 for 1,450,000

Sold November 2015 for $6,420,000

Woodside Townhomes equity grew so large and to a place requiring a 1031 tax free exchange to capture increased cash flows and opportunities for growth. In a simultaneous 1031 exchange for Southern Highlands Senior Apartments in National City, California. Over a 23-year hold, between Capital Appreciation of $4,970,000 and substantial cash flows, the overall investment return was over 40% annually. Returns continue to grow in the exchange property. Equity has been captured and put to greater work in Southern Highlands.

Lake Mead Estates

160 Unit Apartment Complex

Las Vegas, NV

Purchased in 1995 for $5,200,000

Sold January 2014 for $6,000,000

During the ten-year ownership period, the property proved to be significantly cash-flow positive investment over the whole period despite the recession.

Esperanza Village Apartments

90 Unit Apartment Complex

Colorado Springs, CO

Purchased in 2010 for $3,900,000

Sold in 2013 for $4,900,000

Bought out of foreclosure from a Chicago based financial institution, we acquired 90 out of 111 units of this broken condominium project, upgraded units and increased rents.

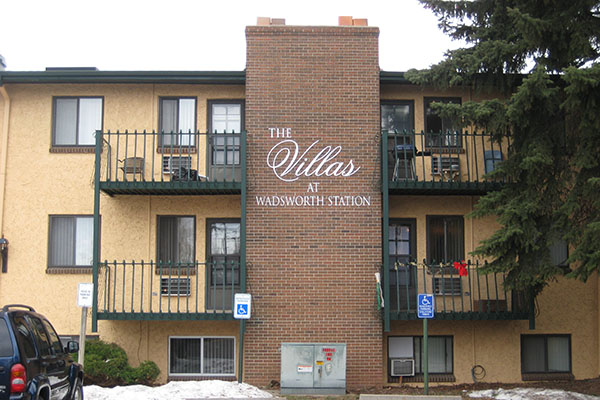

Villa La Salle / The Villas at Wadsworth Station

100 Unit Apartment Complex

Lakewood, CO

Purchased in 1995 for $2,850,000

Sold Dec 2012 for $7,000,000

During the ownership period the property enjoyed significant cash-flow, returning on average 40% per annum on investment.

Old Mill Portfolio

Commercial Complex

Salt Lake City , UT

We sold Old Mill Portfolio to a local SLC Investment Group for nearly what we paid ten years earlier. Having maintained through the Great Recession, increased the NOI, and added on an excellent mix of retail and office users, it was time to move on. Cap rates moved up, so we sold at a slight loss and cashed out of this investment. One of the few properties sold at an economic loss, although we enjoyed significant tax benefits during the whole period.

Chelsea Park Condominiums

39 Unit Ground-up Condominium Development Project

San Francisco, CA (Mission District)

Scratch construction of 39 condominium units in 8 building with interior landscape gardens, in the heart of San Francisco’s Historic Mission District. Coordination and assembly of design, construction and marketing team, entitlement, planning and building permit approval and governing documents (Condominium map). Completed construction, created HOA and sold out the project as individual condominiums. Final Sellout was over $9,000,000.

Seaport View and Seaport Village Condominiums

64 Unit Broken Condominium Project

Vallejo, CA

We purchased a $5,500,000 construction note from Sumitomo Bank for $1,250,000. We then foreclosed the property and obtained title of this unoccupied condominium project. Extensive rehabilitation of 32 existing units, plus new construction of an additional 16 new units. Completed construction, leased up project as a rental while creating HOA, then sold out the project as individual condominiums. Investor Return on Investment approximately 98% within 36 months.

One South Park

35 Unit Condominium Project, at 2nd and South Park

San Francisco, CA

An historical renovation of an early 1900’s tobacco warehouse, to create a 35 unit (5-story) mixed use condominium project. Permits, plans and entitlement and construction completed 2008. Coordinating with design and construction professionals throughout the course of the project. Completed construction and sold out the project as individual condominiums.

More History

- 1990 Purchased 90-unit apartment complex in Redding, Ca for $3,200,00, sold two years later for $4,000,000, moderate rehab and upgrade.

- 1989 100 units in Pacifica, CA, price $4,850,000. Sold in 1991 for $5,200,000.

- 1985 Single Family Home Rebuild Project in Piedmont, CA. Purchase Price $450,000. Sold in 2005 for $1,850,000.

- 1985 Multi-family16 unit interior and exterior rehab project in Mill Valley, Marin County, CA. Purchase price $850,000. Sold in

- 1989 for $2,400,000.

- 1984 Purchased 26 units in Santa Rosa, CA. Purchase price $1,250,000. Sold in 1992 for $1,650,000.

- 1983 Condo rehab project in Pacific Heights, San Francisco, CA. Purchase price $90,000. Sold in 1985 for $105,000.

- 1980 Single unit condo rehab project in Nob Hill, San Francisco, CA. Purchase Price $90,000. Sold in 1980 for $180,000.

- 1977 Single family home rehab project in Oakland, CA. Purchase Price $90,000. Sold in 1985 for $275,000.